will advance child tax credit payments continue in 2022

Its a mechanism for distributing the tax burden based on ability to pay. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Many people are concerned about how parents.

. Last December the CBO estimated that making the 2021 credit under ARPA and the TCJA permanent would cost 1597 trillion between 2022 and 2031. But this may not preclude these payments. Businesses and Self Employed.

Those payments ended in December and theres no indication yet that the child tax credit will be enhanced for 2022. I have written detailed articles covering FAQs for this payment but the main one being asked now is whether or not families will continue to get paid monthly in 2022 starting with the first payment on January 15 2022. However Congress had to vote to extend the payments past 2021.

As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the 2022 tax year and there will be no advance payments offered to families. Rather its maximum value will simply return to 2000. The advance Child Tax Credit payments that were sent out last year have officially come to an end.

It also created monthly advance payments for the latter half of the year. But during the development of the child tax credit there was also a recommendation from the National Commission on Children to introduce a child tax credit that was 1000 per child and fully refundable. The JCT has made estimates that the TCJA changes.

Lawmakers allowed the expanded Child Tax Credit benefits to expire in late 2021 but there may still be hope for an agreement -- and more monthly payments. The advance payments are 50 of the credit youre expected to qualify for when you file your 2021 tax return. Parents get the remaining child tax credit on their 2021 tax returns.

File a federal return to claim your child tax credit. If families get a letter from the IRS saying how much they received from the advance CTC they should keep the letter because it will have important information for filing their 2022 return. Therefore child tax credit payments will NOT continue in 2022.

Families who utilized the six monthly advance payments can expect to receive 1800 for each child age 5 and younger and 1500 for each child between the ages of. What we do know is that the final payment from the. If the total of your advance Child Tax Credit payments is greater than the Child Tax Credit amount that you are allowed to claim on your 2021 tax return you may have to repay the excess amount on your 2021 tax return during the 2022 tax filing season.

While low- to moderate-income parents across the nation came to rely on the early tax payments. If you received advance payments you can claim the rest of the Child Tax Credit if eligible when you file your 2021 tax return. The payments were monthly.

Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. The Child Tax Credit for 2021 introduced a new feature. In 1996 when the credit was first enacted it was 500 per child.

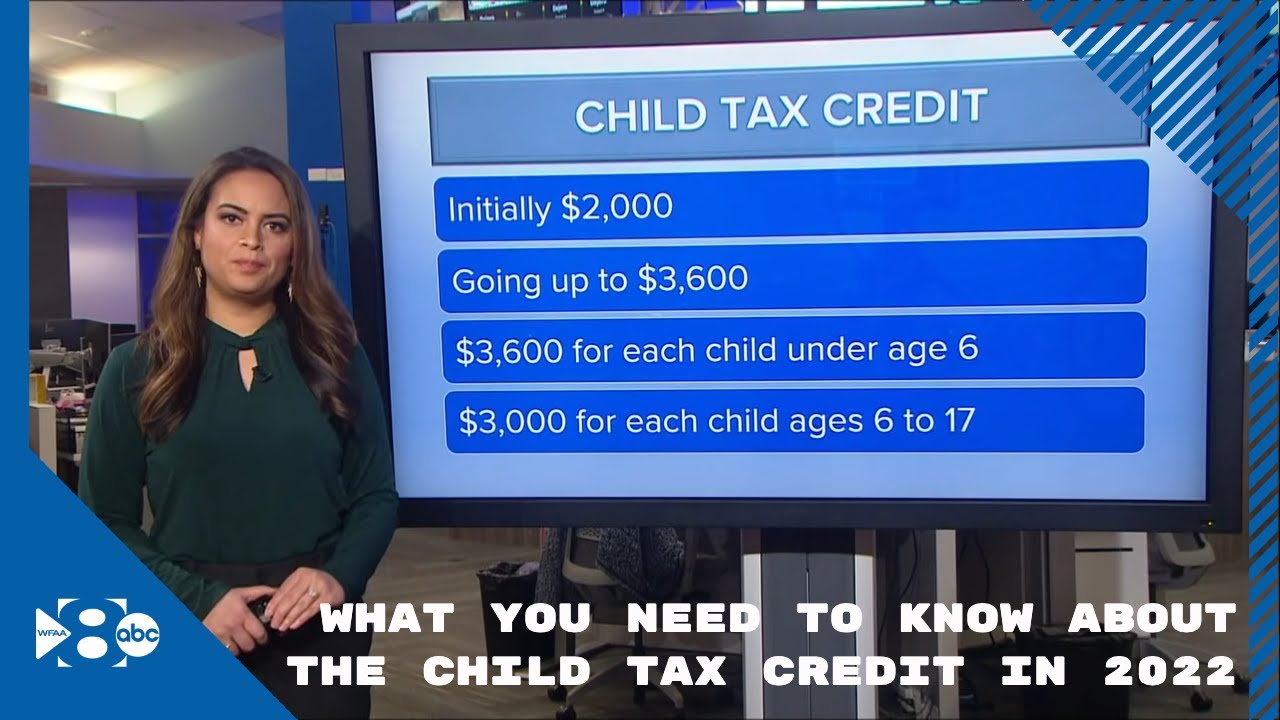

The Child Tax Credit is worth 3600 for children ages 5 and under and 3000 for children ages 6 through 17 at the end of 2021. It isnt considered taxable income and it wont affect any government benefits. Prior to 2021 the Child Tax Credit maxed out at 2000 per eligible dependent.

Earned Income Tax Credit. Families are Eligible for Remaining Child Tax Credit Payments in 2022. The enhanced child tax credit including advance monthly payments will continue through 2022 according to a framework democrats released thursday.

If no measure is taken the Child Tax Credit will revert to the pre-2021 Child Tax Credit where qualified families would be able to claim up. For example if you received advance Child Tax Credit payments for two. Now if the current payment amounts do not pass in Congress.

This year the credit isnt gone. For parents who opted out of the advanced child tax credit payments in 2021 they will be able to claim the full credit if they qualify on their 2021 tax return. Taxpayers could receive direct advance payments of their Child Tax Credits in amounts of 250 or 300 per qualifying child depending on their age.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. The last round of monthly Child Tax Credit payments will arrive in bank accounts on Dec. 15 but doubts arise around the remaining amount that parents will receive when they file their 2021 income.

As of now the size of the credit will be cut in 2022 back to 2000 some families earned up to 3600 in 2021 with full payments only going to families that earned enough income to owe taxes. Simple or complex always free. The short answer is NO since a funding extension for 2022 payments has not yet been approved by Congress.

Last December the CBO estimated that making the 2021 credit under ARPA and the TCJA permanent would cost 1597 trillion between 2022 and 2031. Treasury distributed payments beginning in July 2021. As such the future of the Child Tax Credit advance payments scheme remains unknown.

To be eligible for the full child tax credit single parents must have a modified adjusted gross income under 75000 per year. The legislation needs the votes to pass but with Congressional break and division among some democrats any vote will now come in the new year. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of.

Child Tax Credit 2022 How Much Can You Get Shared Economy Tax

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Feds Launch Website For Claiming Part 2 Of Child Tax Credit Political News Us News

Advance Child Tax Credit Payments Turbotax Support Video Youtube

Taxes 2022 What Families Should Know About The Child Tax Credit Youtube

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Stimulus Payments Start To Arrive The Latest On The Coronavirus Relief Bill The New York Times

Eleven States With Their Own Child Tax Credit Programs Can You Get Up To 1 000 Extra Per Child

Taxes 2022 What Families Should Know About The Child Tax Credit Youtube

No More Monthly Child Tax Credits Now What

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

What You Need To Know About The Child Tax Credit In 2022 Youtube

What You Need To Know About The Child Tax Credit In 2022 Youtube

Possible Child Tax Credit In Vermont Could Give Families 1 000 Per Kid

Federal Reserve Banks Share Information About Advance Child Tax Credit Payments

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy